How Visa’s New Fraud Rules Could Impact Your Business—and How to Stay Ahead

December 2, 2024

Head of Risk

Big changes are coming to how fraud and disputes are managed. The new Visa Acquiring Monitoring Programme (VAMP), set to launch in April 2025, introduces stricter fraud thresholds and expanded metrics across the UK and EU, raising compliance standards for both acquirers and merchants.

For acquirers, this means closer monitoring of merchants and tougher limits to meet. For merchants, your fraud and dispute levels will play a bigger role in shaping your acquirer’s compliance—and potentially your relationship with them.

Here’s what merchants and acquirers in the UK and EU need to know about VAMP and how to stay ahead of these changes.

Table of Contents

What is VAMP and What’s Changing?

Visa’s new VAMP will be replacing its previous monitoring systems with several key updates. Here’s a breakdown of what’s changing:

Lower Fraud and Dispute Thresholds for Acquirers

Acquirers must keep fraud and dispute ratios below 0.5% by April 2025 and 0.3% by January 2026, requiring close monitoring of their merchant portfolios to ensure compliance.

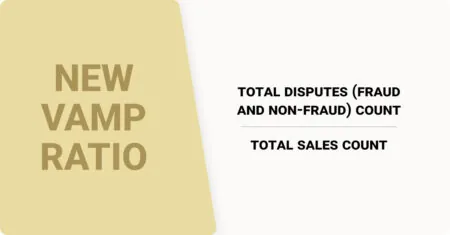

A Stricter Calculation Method

VAMP introduces a new ratio formula that includes disputes like reported fraud transactions (TC40) in addition to non-fraud disputes. This more comprehensive metric pushes both acquirers and merchants to resolve disputes early.

(Count of Reported Fraud + Count of Non-Fraud Disputes) ÷ Count of Total Transactions

This change reflects Visa’s push for a more comprehensive view of risk and makes it crucial for merchants and acquirers to manage disputes before they escalate into chargebacks.

Accountability for Merchants of All Sizes

In the past, smaller merchants or those with lower transaction volumes often went unnoticed in fraud monitoring. VAMP changes that with stricter thresholds designed to hold more businesses accountable. However, the new rules only apply if there’s a monthly minimum of 1,000 combined fraud and non-fraud disputes. For merchants and acquirers meeting this threshold, proactive fraud prevention and effective dispute management are no longer optional—they’re essential for staying compliant.

What Do These Changes Mean for Merchants and Acquirers—and How to Prepare

The new VAMP requirements call for merchants and acquirers alike to rethink their compliance efforts. Staying ahead will require a proactive mindset and tools that simplify risk management.

For Merchants

- Understand the New Rules: Familiarise yourself with Visa’s updated thresholds and calculation methods to avoid penalties or disruptions.

- Strengthen Fraud Prevention: Tools like 3D Secure and AI-driven fraud detection are now essential to keeping fraud levels under control.

- Monitor Trends and Metrics: Work closely with your acquirer to track your fraud and dispute ratios in real-time, identifying areas for improvement.

- Resolve Disputes Quickly: Tools like Verifi by Visa can help manage disputes before they escalate into chargebacks—and importantly, refunds processed through Verifi don’t count toward your VAMP ratio.

For Acquirers

- Proactively Monitor Your Portfolio: Real-time monitoring is key to identifying trends and addressing merchant risks before they escalate.

- Onboard Merchants Strategically: Use the onboarding process to flag potential risks and set clear compliance expectations from the start.

- Maintain Open Communication: Sharing performance data and offering guidance helps merchants course-correct and stay compliant.

To meet these stricter requirements, merchants and acquirers alike must embrace smarter tools and proactive strategies.

How Fibonatix Can Simplify VAMP Compliance for Merchants

With VAMP’s changes putting more pressure on merchants, it’s crucial to have the right systems in place. Fibonatix specialises in turning compliance challenges into opportunities.

- Fraud Prevention That Works: We provide advanced fraud detection tools, including 3D Secure and real-time monitoring, to help you stay compliant.

- Streamlined Dispute Management: Our tools simplify dispute resolution, protecting your compliance metrics and minimising chargeback risks.

- Real-Time Insights: We make tracking fraud and dispute metrics easy, helping you identify and resolve issues proactively.

- Tailored Support: Every business is unique. We provide bespoke solutions to meet compliance requirements and build strong relationships with acquirers.

At Fibonatix, we make VAMP compliance simple, so you can focus on what you do best—growing your business.

Conclusion: Turning Compliance into Opportunity

Visa’s new VAMP programme isn’t just about stricter rules—it’s about creating a more secure payments ecosystem. While the compliance bar is higher, merchants and acquirers willing to adapt can turn this challenge into a competitive advantage.

By adopting smarter fraud tools, efficient dispute management, and real time monitoring, you can reduce risk, strengthen acquirer relationships, and set your business up for long-term success. Fibonatix is here to help every step of the way. With the right tools and expertise, you’ll be ready for the 2025 deadline—and beyond.