Fraudulent transactions are a reality that many merchants, customers and payment service providers will contend with at some point or another. They are not as widespread as believed, but the remedy that card schemes use to minimise fraud, a payments fraud report, can be challenging for businesses. We explore fraud in relation to chargebacks, how fraud reports work and how your business can identify and prevent fraudulent transactions.

The insights in this blog are based on Episode 11 of our Pay Attention Podcast, hosted by Fibonatix CEO Tal Miller. In this episode, Tal explores payments fraud reports and how to manage fraudulent transactions. Listen via the player below or scroll down to continue reading.

Table of Contents

Misconceptions around fraudulent transactions and what constitutes fraud

Because of the prominence and impact of chargebacks, merchants and consumers alike assume that fraud is a widespread issue that occurs frequently, and that “chargeback” and “fraud” are interchangeable. This misconception has developed as a result of abuse of the chargeback mechanism, which, although intended to protect consumer interests, makes unwarranted refunds very easy to access.

Differentiating between fraud and chargebacks

Although fraud is a very commonly used reason code category for initiating official chargeback processes, fraud (and the accompanying fraud reports issued by card issuers like Visa and Mastercard) is completely separate from chargebacks and the chargeback process. Merchants and consumers need to be aware of the differences between the two and the impact both have.

For more information on how chargebacks affect merchants, read our blog on how to manage chargeback risk.

Payments fraud reports explained

Where a chargeback is a forced refund that a customer forces on a merchant for whatever reason, payments fraud reports are initiated by the banks and card issuers on behalf of the customer. Because chargebacks originate with the cardholder themselves, the chargeback process relies on customer participation. Fraud reports, on the other hand, are issued by card issuers without the participation or, sometimes, knowledge of the customer.

What is a payments fraud report?

A payments fraud report is when a financial organisation that issues cards flags a fraudulent transaction. More often than not, fraud reports are generated by automated systems flagging what appears to them to be suspicious transactions. These systems look at defined parameters and if purchasing characteristics differ from what is known/expected of a consumer, they flag the transaction. These characteristics include spending amounts that seem larger than what one typically spends, the location and time of the transaction, and business types that don’t match customer buying habits – one such scenario we’ve experienced of this, as an example, is an elderly customer purchasing Bitcoin.

How should merchants deal with a payments fraud report?

Merchants need to remember that transactions are often reported as fraud, but not charged back, and chargebacks with fraud reason codes aren’t necessarily a result of fraudulent transactions. Luckily, unlike chargebacks, payments fraud reports don’t have any direct financial implications on the merchant at the point of being issued. However, fraud does still have an impact from a performance indicator perspective. So, merchants should take note of fraud reports against their business, track their fraud-to-sales ratios and do what they can to mitigate them in the future.

What implications can a fraud report have on your business?

The fraud levels of payment service providers (PSPs) and businesses are closely monitored by card schemes and if a certain threshold is exceeded, the faulted party will be penalised. Card schemes can either terminate your account entirely or implement measures like rolling reserves. These, however, can lead to financial damages. As such, actively monitoring the number of fraudulent transactions flagged for your business is important.

How to identify fraudulent transactions

Identifying a fraudulent transaction can be difficult, especially when most cases of fraud are not actually fraudulent, but rather so-called “friendly fraud”. However, when they are reported to your business, card issuers do use specific terminology to identify the reports. Visa’s payment fraud reports are referred to as TC40 and Mastercard’s are referred to as SAFE reports. Should you see these terms used, you can be assured the reported incident is a fraudulent transaction.

Measuring payment fraud levels

Because of the penalties associated with high payments fraud reports for merchants and PSPs alike, tracking and monitoring your payment fraud levels is an important KPI in measuring your business’ performance. Taking time to calculate your fraud-to-sales ratio can help you get a sense of the severity of the situation, which can help you decide the best precautionary steps to reduce the ratio in future, and minimise fraud reports’ impact on your business.

Fraud-to-sales ratios

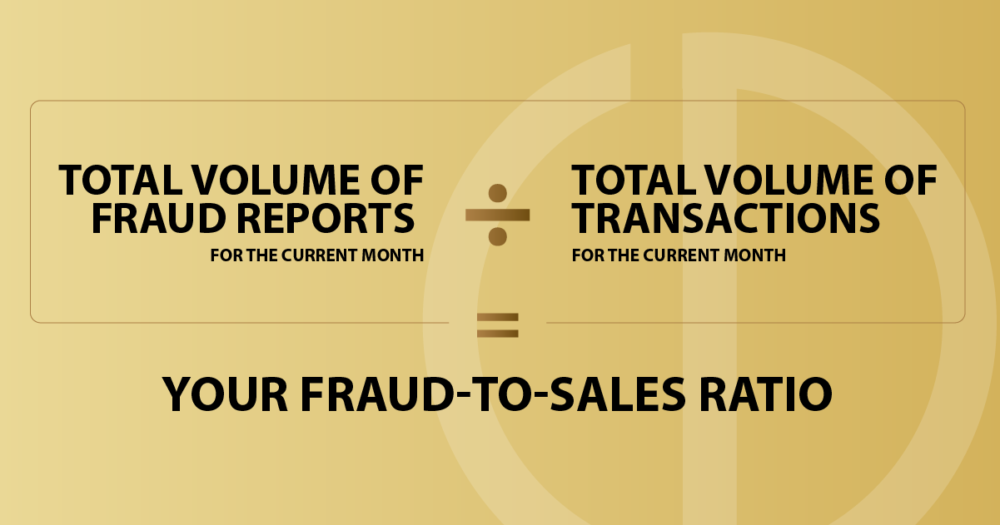

A fraud-to-sales ratio, also known as F2S, is a volume-based percentage figure businesses use to work out how many fraudulent transactions they have from their sales. You calculate it by taking the total volume of fraudulent transactions reported in a month and dividing that by the total volume of transactions in that month.

Typically, it’s believed that your fraud-to-sales ratio should be below 1%, but this percentage is very much industry-dependent, as some industries are known for higher F2S ratios. Industry standards are an important consideration when calculating your fraud-to-sales ratio.

Fraud prevention and regulatory obligations

Payment regulations are wrought with requirements to try and prevent consumer payment fraud as much as possible, with many even making digital measures mandatory to merchants. But whether transactions are fraudulent or not, too many payments fraud reports against your business are risky, and as such, analysing them and understanding why they’re happening is key for helping you identify where fraud can be better prevented, or where you can make adjustments to minimise fraud reports.

4 steps to manage and reduce fraudulent transactions

Here are some steps you can take to try to reduce fraudulent transactions and fraud reports in your business:

1. Benchmarking

Calculate your fraud-to-sales ratio and look at your industry benchmark, bearing in mind that high fraud-to-sales ratios can be industry-specific.

2. Try to understand why the fraud reports are happening

Remember, 99% of fraud reports are triggered by automated systems, so look into the data for common denominators. Some factors to consider include:

- Does a certain amount threshold trigger most reports? If so, look at your pricing and adjust accordingly.

- Is the timing of your billing system causing a response? Then adjust your billing system time to process payments at a more expected time, or have customers let their card issuer know to expect a payment to occur at an unusual time, so it’s not flagged as fraud.

3. Use 3D Secure

Although not favoured by merchants due to additional steps being added to the transaction process, 3D Secure is now a market standard and mandatory in some jurisdictions. Using 3D Secure improves overall approval ratios for merchants, especially across international markets, while also reducing fraud. Generally, any conversion damages experienced as a result of 3D Secure are often offset by improved approval ratios.

4. Have clear and transparent communication with your customers

If certain transactions are flagged more often than others, let them know so that they’re prepared should their card scheme flag their transaction as fraud.

How payment service providers can help

Discussing your payments fraud reports, fraudulent transactions and fraud-to-sales ratio with your payment service provider can help you get a good perspective on the situation. A good payment service provider will provide insights and advice to help you identify and rectify payments fraud report triggers. Ask them about other merchants in your industry and any datasets they may have to help you find patterns in your transactions that lead to fraud reports. It’s in their best interest to help you mitigate them as they are also monitored and penalised for fraud by card issuers. Use their expertise to help you handle and prevent fraud.

Summary

As a business, you will encounter payments fraud reports. Awareness of how they work and being proactive in taking steps to prevent and manage them is vital for ensuring you don’t suffer potentially damaging penalties. Partnering with a payment service provider with the knowledge and expertise to help you navigate fraud reports and mitigate fraudulent transactions will equip you with the relevant information and tools you need to manage fraud risks and their potential repercussions for your business. Fibonatix offers various support services for merchants, including payment consulting and risk management. If you’d like to know more about how we help businesses to manage risk and support with chargebacks and fraud, get in touch or browse our range of payment support services.

Fibonatix is a global payment service provider offering bespoke payment solutions and supporting services for merchants of all types and sizes. We’re FCA regulated, with offices in the UK, Germany and Israel. We empower businesses with cutting-edge payments processing tools and our vast experience in payments consultancy to drive business growth.